LETS Banking Systems Engineering Math

Banking System Blueprint

by John C. Turmel, B. Eng.

INTRODUCTION:

In GRACE AND MORTGAGE by Bishop Peter Selby, Bishop of Worcester,

ISBN 0-232-52170-0, page 116:

As Galbraith remarks, higher interest rates, it is hoped, "will

curb inflation." These comments of Galbraith illustrate why,

although

the raising of interest rates is the weapon against inflation chosen

by those who profit by it, it is also clear that as a method it cannot

finally work. John Turmel, a Canadian civil engineer and campaigner

against usury, has in two long articles brought algebra, plumbing and

poetry to bear on the task."

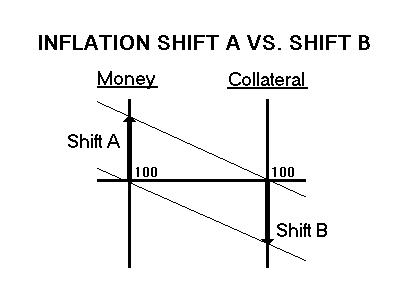

JCT: Just as ClimateGate exposed the big lie that CO2 is causing

global warming, InflationGate exposes the Big Lie of Economics

that interest fights inflation based upon the assumption that

inflation is more money chasing the same goods, Shift A, whereas

I've proven that it is actually the same money chasing less goods

after foreclosure, Shift B. Shift B inflation is unknown in economics

but the following analysis explains why inflation in Argentina went

from 1000% down to 36% after several provinces instituted local

provincial LETS bond currencies.

ANALYSIS:

The problem of exponential growth of debt is created within the

banking system and therefore a thorough understanding of the banking

system is helpful. The money system is the only mechanical system

which is under the jurisdiction of economists, not engineers.

Improvements are taking place in all system areas except the financial

system. It's time engineers turn their attention to this errant system

from which come all the financial woes of the world.

As an electrical engineer to have specialized in banking systems,

I will endeavor to explain the inner workings of this mysterious

system and its effects on users and debt. Though this might sound

daunting, I think I can present an easy way of handling subjects such

as:

- plumbing modeling of flows of money with pipes

- simple algebra

- exponential functions

- differential equations

- Taylor Series

- Laurent Series

- Laplace transformations

- control system circuitry

ECONOMIC FALLACIES

The two Big Double-thinks of Economics are that:

1) Banks lend their depositors' savings.

2) Interest rates fight inflation;

Banks do not lend out their depositors' funds, they lend out brand new

money. InflationGate means Interest does not fight inflation, it causes

it.

HOW BANKS CREATE MONEY

The inner workings of the engineering design of the global

"fractional reserve" banking system are mysterious to many

but no

matter how complex the actual process of creating money is, it can

accurately be simplified to "HAVING THE MONEY PLATES,"

whether they be

plates for changing metal to coins, plates for changing paper to

notes, or plates inside a bank's computer changing electrical blips to

bank deposits on which checks may be written.

Since changes in the money supply are regularly reported, money

must enter the supply from a source and leave through a sink. Our

liquidity system has both a tap and a drain. Since the government

borrows money itself, it does not have control of the tap. Who

controls the tap and the drain of the money supply?

The easiest way to model our system of financial liquidity is

with plumbing. All banking systems have the same exterior connections

to the economy.

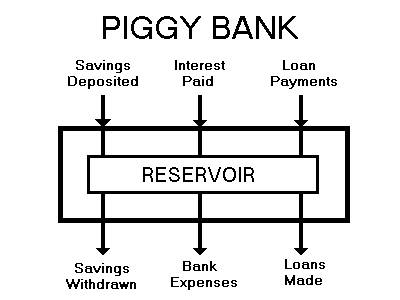

Fig. 2 is the interior plumbing of a piggy bank reservoir system

which shows that a deposit is first made into the reservoir and a loan

is then taken out of the reservoir which causes no increase in money

supply. Conversely, when a loan is paid, it goes into the reservoir

and there is no decrease in the money supply. A reservoir piggy bank

system does not affect the money supply because there is no tap and no

drain.

Though the Bank of Canada operates a tap and adds a small amount

of "high-powered" money to the money supply, Graham Towers, a

former

Governor of the Bank of Canada, pointed out that "The banks do not

lend out the money of their depositors. Each and every time a bank

makes a loan, new bank credit is created, new deposits, brand new

money." So a chartered bank has a tap and is not the pure

reservoir

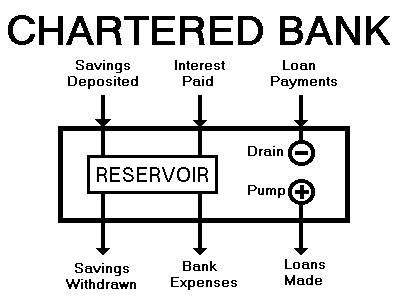

system like a piggy bank model! Fig. 3 is the interior plumbing of a

chartered bank which shows that the loans do not come out of the

savings reservoir but come out of the tap of new money. When a

chartered bank makes a loan, the amount of money in circulation goes

up. When a loan is repaid, it goes down. In the textbook Economics

by Lipsey, Sparks, Steiner, it states "The banking system as a

whole

can create deposit money." Therefore, the banks all have their

very own

tap, their very own set of electronic money plates.

The famous "reserve ratio" of a "fractional reserve

system" sets

the limit on the amount of new money the private banks may create. It

simply means that a fraction of all deposits is sent to the Bank of

Canada's reservoir and the bank is then allowed to turn on the tap to

match the deposits remaining in their reservoir. Banks create most of

the money in circulation. To go step by step through the fractional

reserve banking system's plumbing with a 10% reserve ratio, let the

Bank of Canada turn on its tap and put $100 of "high-powered"

new

money into circulation. Each time a loan is made, the borrower always

eventually deposits it into the banking system.

| BoC | Saved Accts | IOU's | New$ | |

| Deposit old $100: | 10 | 90 | 0 | |

| Loan out new $90 for $90 IOU | 90 | 90 | ||

| Deposit new $90: $9 BoC $81 Bank | 9 | 81 | 0 | |

| Loan out new $81 for $81 IOU | 81 | 81 | ||

| Deposit new $81: $8 BoC $73 Bank | 8 | 73 | 0 | |

| Loan out new $73 for $73 IOU | 73 | 73 | ||

| [...............................] | ||||

| Deposit new $10: $1.00 BoC $9.00 Bank | 1 | 9 | 0 | |

| Loan out new $9.00 for $9.00 IOU | 9 | 9 | ||

| [............................... to infinity] | ||||

| -------- | ------ | ------- | ------ | |

| $100 | $900 | $900 | $900 | |

| Old | New Savings | New | New$ |

Where the system started with only $100, after the expansion is

over, the Bank of Canada is holding the original $100 as the banks'

10% reserves and the banks' reservoirs are holding the other $900 of

the savers' new deposits. So, $900 newly created dollars were added to

the system by the private fractional reserve banks for every $100

issued by the Bank of Canada. This limit is the inverse of the reserve

ratio. A reserve ratio of 5% would generate total new money of 1/.05 =

20 times the initial high-powered Bank of Canada money. This is how an

ordinary bank creates new money as new loans based not on the

production possible but on past savings of money.

Monetary reformers who think that money issued by the banks is

fraudulent valueless money are incorrect. It is evident that all the

new money issued is originally backed up by collateral or personal

IOUs pledged at the time of the loan.

Monetary reformers who think that banks use $100 to lend out $900

and collect interest on the whole $900 are incorrect. It is evident

that most interest is paid to depositors and used for expenses at

every stage. I call this belief the "Voorhis Mistake." Sorry

Jerry. You

were right on so much else. .

HOW BANKS DESTROY MONEY:

Just as money is newly issued from the tap when a bank makes a

loan, money is destroyed down the drain when a borrower makes a

principal payment. Interest payments go back into the reservoir and

not down the drain.

When a large withdrawal is made or a large failure is written off

the banks' books, the reverse reserve ratio process takes place. Since

losses are covered from reserves upon which are based the loans, when

their reserves go down, they have to call that amount in loans. It's

quite an automatic doomsday mechanism. It was bankers calling in loans

which precipitated the 1929 stock market crash. As people fail to meet

their call and those loans are written off again reducing the bank

reserves, more loans must again be automatically called in. The

process gets worse and causes the banking system to fail.

Any cabal of rich men can precipitate such a "credit

crunch" by

simply moving their savings to another country which forces the banks

in the target country to start calling in loans. Such private power

over the world's financial system is inappropriate.

HOW BANKS CONCEAL THEIR CREATION OF MONEY:

The injection of new money from their taps has been well hidden

from the public view because the Bank Act insists that before any new

money may be loaned into circulation, old money must be deposited into

their reservoirs. It's just as if a casino were to insist on old chips

being put into the safety deposit section before it would issue new

chips. By merely matching new loans to deposits, this brilliant cover

for the turning on of the tap misleads observers into falsely

concluding that a chartered bank operates like a piggy bank. With a

lawful reason to seek deposits before they can lend, there is no

outward difference between chartered bank and a piggy bank. Yet, banks

do not seek deposits to lend to other people. They seek them to

lawfully turn on the tap of new money leaving depositors' old deposits

in their accounts.

It's a fascinatingly tricky mechanism but it's purpose is to

foster the impression that borrowers are getting savers' deposits and

that savers therefore deserve to get interest for lending borrowers

their money. This may have surely been true when banking did operate

like a piggy bank without the creation of new money but it certainly

is not true now that banks operate more like a casino banks issuing

new liquidity. The matching of loans to deposits successfully hides

the fact that no one is giving up the current use of their money since

it is new money being loaned out and therefore no one is being

deprived of the use of their money.

DOUBLE-THINK #1

Understanding now where bank loans come from, we can see the

double-think that has been brainwashed into economic thinking.

According to George Orwell in "1984," to double-think was

having the

ability to accept two contradictory points of view as both

simultaneously true.

I noted a perfect example of economic "double-think" in an

article on the sci.econ Usenet newsgroup on Aug 24 1995 by

wfhummel@netcom.com (William F. Hummel). In one paragraph, he said:

"A

bank loans money that it receives from other depositors..." This

is

exactly how everyone thinks a savings bank works, just like a piggy

bank. No source of new money, no tap. Just a reservoir.

In another paragraph, he said: "The money supply increases

whenever a bank creates a new loan, and it decreases when the loanee

pays off the loan."

Both these statements cannot be true. Either borrowers are

getting savers' deposits or they are getting new deposits. Though we

know this is true that piggy banks lend out their depositors' savings,

we also know that it is not true of the private chartered banks which

are lending out new money which is expanding the money supply. This is

one of the great double-thinks of economics. The more you've studied

economics, the more you learn to believe that loans going out are new

money at the same time as being old money.

Try it. Ask any economist where the banks get the money from

their loans, 99% will answer "from their depositors." Then

ask if it

isn't true that economics books say that banks are creating new money

when they make loans and they'll agree right away without realizing it

has just contradicted their previous belief that these new loan funds

were depositors' old savings funds.

REAL POWER OF CONTROL OF LOAN CREATION:

The real power of banking is being able to refuse to turn on the

loans tap for one businessman and foreclose while turning it on for a

new loan to another businessman so he can buy out the first

businessman at auction.

CASINO BANK

The major difference between a casino bank and a chartered bank

is that the liquidity from a casino bank never suffers inflation while

the liquidity from a chartered bank always suffers inflation. Since

the hardware of a casino bank, chips of different colors and

denominations, is functionally identical to the hardware of a

chartered bank, computer credit pulses and coins or paper of different

colors and denominations, inflation is not a hardware problem. It is a

software problem. There is something wrong with the software program

which regulates how money is put into and taken out of circulation.

There is nothing wrong with the hardware. It is the operators of the

taps who are improperly restricting the flows.

To fully appreciate our present predicament, consider a station-

master in a wartime situation who was ordered to ensure that an

invading army did not capture the rail system in operating condition

and burned all of the railroad tickets. Our failure to use our

manpower, materials and tools because there are insufficient monetary

tickets puts us in the same category as the invading army who failed

to use the captured railway because they couldn't find any railway

tickets. To get out of this silly predicament, public control of the

money tap must be regained from the private banks.

HOW "MORT-GAGE" INTEREST CREATES A DEATH-GAMBLE

csurvive the mort-gage death-gamble.

P < principle, I < Interest, i < Interest Rate, t < Time

| Production Costs (Principal) | 100 | P | 1 | |

| Production Prices (Debt) | 100+I | P+I | exp(it) | |

| Purchasable Value (Survivors) | 100/(100+I) | P/(P+I) | 1/exp(it) | |

| Unpurchasable Value (Non-survivors) | I/(100+I) | I/(P+I) | 1-1/exp(it) | |

| For Unemployment = 0, let: | I=0 | I=0 | i=0, t=0 |

The odds of survival are always set by the interest rate(i).

P/(P+I) survive, I/(P+I) do not.

There is a tricky way to avoid the death-gamble in a mort-gage contract!

If it's a problem borrowing 10 and owing 11 at the end of the contract,

the simplest solution is to pay the interest up front so you can earn the 10th

chip from the banker before you have to pay off the 10! If you paid Principal

up front, that would go down the drain and you can't earn it back. But paying

the interest up front goes into the reservoir of existing money. By paying the

interest up front rather than at end converts the unpayable usury into a

payable service charge! If only the suckers knew.

INFLATION

The equation for the minimum inflation (J) we must suffer is the

same as the equation for unemployment (U) because the fraction of the

people foreclosed on is the fraction of collateral confiscated. Though

we

are led to believe that inflation is caused by an increase in the money

chasing the goods (Shift A), actually, it is caused by a decrease in

the

collateral backing up the money (Shift B) due to foreclosures. Though

both inflations shifts feel the same, the graph shows inflation is not

the

inverse function of interest, it is the direct function exposing the

Big Lie

that interest fights inflation. (Fig. 4)

Most people who have not studied economics, if asked whether

interest fights or causes inflation, are quick to agree that a

merchant must pass on increased interest costs in his prices and

therefore it is evident that increased interest costs will result in

increased prices. How they then accept politicians who tell them

interest fights inflation is a measure of double-think too.

DIFFERENTIAL EQUATIONS

Where "B" is the original bank balance, "i" is

the rate of

interest and "t" is time, the differential equation for your

bank

account is:

dB/dt = iB

The "d" stands for "delta" or

"change."

So "dB" is the delta change in the Balance.

So "dt" is the delta change in the time.

So the rate of change of your bank balance over time equals your

balance times the interest rate: iB. We can now examine the problem,

not over one cycle with algebra, but over time with exponential

functions. The solution to the differential equation dB/dt=ib is

exp(it). Exp(it) means that your balance will exponentially double and

double in time as a function of the interest rate. It is a crooked

non-linear function.

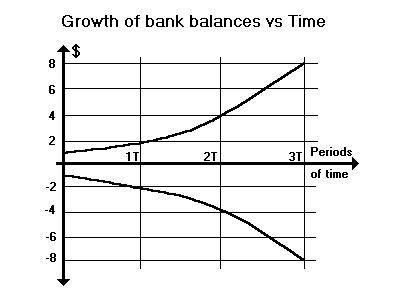

Consider that if two men are in a car accident and one owes the

other $1. Fig. 5 shows that if there is no interest, the debt stays

friendly and sociable like the two straight lines for one owing $1 and

the other being owed $1. The two straight lines from at +$1 and -$1

represent the growth of their debt and credit. Zero growth. If there

is interest, the balances start to grow with time and double in time

T, then again in time T and again and again into the exponential curve

exp(it).

LAPLACE TRANSFORMATIONS

Laplace Transformations are a branch of mathematics which allows

engineers to manipulate complex system differential equations

algebraically. Like magic, we transform tough real world functions

from real numbers into a function of the Laplace variable "s"

in the

imaginary number dimension. There we do our computations algebraically

and then reverse transform from the imaginary number dimension to the

real world solution. Nothing in my engineering studies has ever awed

me as being more powerful than Laplace Transforms and what can be done

with them.

TAYLOR SERIES

We want to get the Laplace transform of a bank account which

makes an original Balance B grow as B*exp(it). We expand the bank

account function exp(it) into it's Taylor Series:

exp(it) = 1 + it + (1/2!)*(it)^2 + (1/3!)*(it)^3 + ...

LAURENT SERIES

Taking the Laplace Transform of each component of the Taylor

Series produces the Laurent Series of the banking system:

LT{exp(it)} = LT{1 + it + (1/2!)*(it)^2 + (1/3!)*(it)^3 + ...}

LAURENT SERIES = 1/s + i/(s^2) + i^2/(s^3) + i^3/(s^4) + ...

= (1/s)*(1 + i/s + (i^2)/(s^2) + (i^3)/(s^3) + ...)

= (1/s)*(1/(1-i/s))

= 1/(s-i) = USURY BANK ACCOUNT LAPLACE TRANSFORM

The moment the debt passes through the (1/(s-i)) usury filter in

banking system, it starts to grow.

The differential equation for inflation (J) whose solution is (1-

exp(-it)) can be described as:

dJ^2/dt^2 + (i)*dJ/dt = 0 or j'' + (i)j' = 0

The Laplace Transformation of the inflation (J) is: 1 / ( s^2 + is )

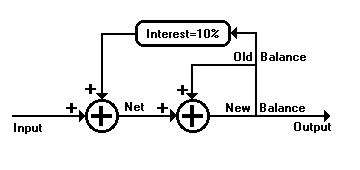

CONTROL SYSTEMS

With the Laplace transform, it is also possible to draw the

electrical blueprint of a bank account in the usury banking system:

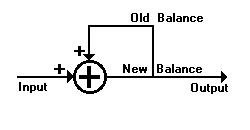

Fig. 6 is the control system blueprint of a usury bank account

which shows that added to any input is the feedback of the interest

rate times the previous balance which can be positive or negative.

This net amount is added to the previous balance to produce the new

balance. This positive feedback makes the system unstable and the root

of bad vibrations.

Your $100 volt pulse is the input to the first addition node.

Added to it is the positive feedback interest voltage from the last

balance which, to start, was 10% of zero volts. The new net $100 volt

pulse enters the second addition node where it also is added to the

old balance, still zero volts, to push the new balance up to $100

volts.

Next year, with no new pulse at the input, added to this zero

voltage is 10% interest, a pulse of 10 volts. The 10 volt pulse goes

into the second addition node where it is added to the old balance,

100, to push the new balance to 110.

After 2 years, you'll have 11 more for a balance of 121.

After 3 years, you'll have 12 more for a balance of 133.

After 4 years, you'll have 13 more for a balance of 146.

After 5 years, you'll have 14 more for a balance of 160.

After 6 years, you'll have 16 more for a balance of 176.

After 7 years, you'll have 18 more for a balance of 194.

After 7.2 years, you'll have 6 more for a balance of 200.

The same growth will apply to an input of -100 volts.

This demonstrates quite well what's called the "rule of

72."

Divide the number "72" by the percent interest, in this case

10%,

and that's approximately the number of years it will take to double,

in this case 7.2 years, and double, and double, etc. That's what's

called an exponential function.

At 5%, it should take about 14.4 years to double.

At 10%, it should take about 7.2 years to double, as shown.

At 24%, it should take about 3 years to double.

Cycle after cycle with no new inputs, you have the exponential

growth exp(it) which grows as the above series. It acts just like

bringing a microphone up to a speaker. The sound from the speaker is

picked up by the microphone and fed back to make the sound out of the

speaker louder which is picked up and fed back to make it louder until

you blow your speaker. Having an unstable positive feedback loop built

into a system makes that system unstable.

Negative feedback loops where the feedback from the previous

balance is subtracted are very useful in stabilizing systems away from

error but positive feedback always makes the error grow. A physical

example of negative, positive and no feedback follows:

If you have a bowl and you put a ball in it and then give the

ball a little shove, it will travel up one side, gravity will bring it

down and it will rock back and forth until it settles back to the

middle. That's how engineers use negative feedback to bring back

things which have been pushed out of normal operation back to normal.

If you turn the bowl upside down and put the ball at the top, one

small push and the gravity will make the ball fall faster and faster.

That's unstable. If you put the ball on a platform and give it a push,

without friction, it will just continue in rolling steady state. Both

zero and negative feedback are acceptable while positive feedback is

always unacceptably unstable.

Engineers say that systems are stable if the pole of the system

is in the left-hand plane or on the origin but unstable if the pole is

in the right-hand plane.

Knowing that the Laplace Transform of the system is 1/(s-i), the

denominator is zero when s=+i and therefore, the pole is on the right-

hand side of the origin, hence unstable.

Eliminating the bad vibrations is as simple as making the

interest feedback loop in the bank's computer programs zero and using

only the simple interior circuit known as an "integrator."

Currency

systems presently using these simple "integrator" accounts

are now

known internationally as Greendollar systems of the Local Employment

Trading System (LETS).

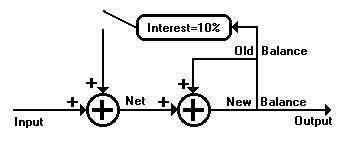

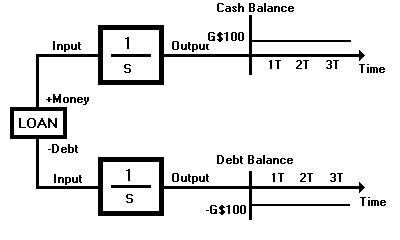

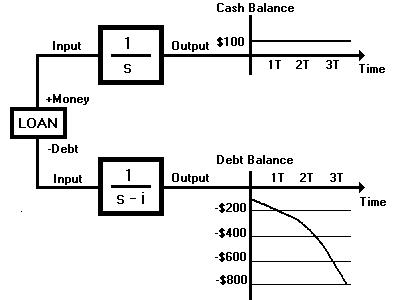

We know that the LETSystem is an interest-free system and so we

cut the positive feedback loop to get 1/(s-0). Fig. 7 shows that to

make the interest positive feedback zero, we simply break the circuit:

Fig. 8 is the interior circuit still left in operation which is the

true

electrical control system of the LETS 1/s bank account. This

is the mathematical circuitry behind all interest-free systems and how

Greendollars work: Instead of an output which is exponential, crooked,

we have an output which is linear, straight. Your $100 volt pulse is

the

input to the addition node. Added to it is old balance, starting at

zero, to

push the new balance up to $100 volts.

Next year, with no new pulse at the input, and with interest

voltage to add, the balance stays at $100 volts. If another deposit

comes in, it's added to the old balance to create a new balance. A

negative coming in will reduce the old balance. But the system is

always in balance. Positives equal negatives.

So now we see how Greendollar credit at a LETS bank works. Fig. 9

shows that when you use Greendollar credit, the amount you have taken

out which is represented by the top circuit and the amount you owe

which is represented by the bottom circuit stay the same:

We can also see how a loan at a normal usury bank works. Fig. 10

shows that while the amount of cash in your wallet is shown by the

upper circuit, the debt for that $100 shown in the lower circuit

starts to double and double over time and all the while, all you have

is original $100 in your possession:

This analysis shows that unemployment and inflation must go to

zero if the banks' computers, which are now permitted to charge both

interest and service charges, are restricted to only the service

charge and the interest charge abolished.

Note that the exponential derivation shows that there are two

solutions to the mort-gage (death-gamble). The software solution is

interest rate(i) = 0 by restricting the banks computers to a pure

service charge and abolishing the interest charge. The hardware

solution is time(t) = 0 by installing an instantaneous electronic

cashless marketplace.

GAME MODEL: SERVICE CHARGE VS. INTEREST

In his book `The Theory of Games and Economic Behavior', John Von

Neumann, one of this century's top mathematicians, stated that

"important questions in economics arise in a more elementary

fashion

in the theory of games." In the business war for markets, the

economy

decides who sells their goods and who fails to. Models used by

economists are flawed by guesses and approximations about what the

economy will choose. The only way to perfectly model the economy is to

use fair chance to pick the winners and losers.

TO PLAY MORT-GAGE:

The necessary game equipment to play "mort-gage" is:

1) 3 types of tokens to represent food, shelter, and energy (the

tokens can be knives, forks, spoons)

2) a fair chance mechanism like a coin, cards, dice, etc.;

3) matches, beans, chips or tokens to represent currency.

Here is how I demonstrated the difference at a dinner party

between the interest on a business loan and the service charge on a

Greendollar LETSystem business. The hostess provided a bag of raw

beans which I used as my model dollars. I used knives as tokens for

food, forks as tokens for clothing and spoons as tokens for services

which I put into a bowl representing the market economy in the center

of the table.

INTEREST-USURY MARKETING METHOD:

In the Interest Game, all borrow 10 but have to inflate their

prices to recuperate the 11 they owe the bank.

Step 1): I had all 10 guests at the table pledge their watch as

collateral for a $10 Beandollar loan. At 10% interest, they each owed

me 11 Beandollars at the end of the loan period.

Step 2) I had all 10 guests spend their $10 Beandollars into the

market bowl in exchange for a product token.

Step 3): Once all 10 guests now had a product token for sale, I

used fair chance to determine who would successfully market their

product. Starting first with pairs of players with similar product

tokens for sale, I flipped a coin to determine which the economy chose

to buy from. Then winner delivered the product token to the market

bowl and collected $11 Beandollars. After the first round, half the

players had successfully marketed their product and half had not yet

sold. Finally, taking diverse pairs, I continued tossing the coin to

decide who the economy chose to purchase from, the winner delivering

goods and taking price out of the market.

Step 4) Since everyone put in 10 and the winners all took out 11,

eventually, the market bowl ran out of Beandollars with one guest

still having products unsold. I foreclosed and seized the loser's

product token and watch.

Step 5) I explained to the winners how their $100 Beandollars had

inflated because there were now only 9 watches.

NO-INTEREST LETS MARKETING METHOD:

In the No-interest Service Charge Game, all guests borrowed 11

and owed 11. The 11th Beandollar borrowed was to pay the bank

employees a service charge.

Step 1): I had all 10 guests at the table pledge their watch as

collateral for an $11 Beandollar loan.

Step 2) I had all 10 guests spend the same $10 Beandollars to

purchase their production token from the market bowl and then spend

their last Beandollar into the market to pay for the services of the

bank employees who facilitated the transactions.

Step 3): I again used the coin to model the decisions of the fair

market and noted that at the end of the game, all the production was

sold.

Step 4): I noted that no one lost their watch even though the

bankers still got paid.

Step 5): I noted that at the end of the LETS service charge game,

there were enough watches for the Beandollars to retain their original

value, unlike in the Interest Game. I noted that everybody had sold

all their product tokens because the 11th unit of money had entered

the market bowl through the bank employees' service charges.

The very subtle difference between systems is that in the

Interest Game, the bank demands payment of money it did not create

while in the LETS Service Charge Game, the bank demands payment of

money it did create. With exactly enough markets to match the prices

of goods produced, there can be no foreclosures.

EQUATION OF RESPONSIBILITY:

This is the argument I offered the Supreme Court of Canada in

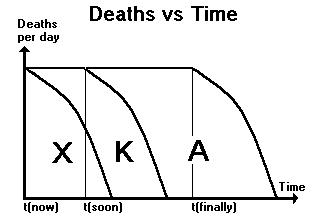

1982 about the UNICEF 1981 estimate of starving children: 46,000/day.

Unfortunately, only the software solution can be implemented now.

Being generous in assuming that the rate of children perishing due to

starvation on the planet will remain constant given the recent flurry

of foreclosures on farm production, Fig. 11 shows the death curve.

Since this software change in the computer's programming is quite

instantaneous, if it were to be ordered at time t(now) and the bank`s

computers immediately restricted to a pure service charge, all those

industries that have recently died will be resurrected by an infusion

of interest-free credit that will allow them to start rehiring as fast

as they start writing new paychecks that need only be exchanged for

work as collateral. This will generate the greatest industrial boom

imaginable. The increase in production would cause the slope of the

death curve to change downwards until the eventual eradication of

starvation due to the maximization of our industrial capacity. Area X

under the death curve represents the number who will perish even if we

flip the economic engine to full power at time t(now) because we won't

be able to get to them in time.

Delaying the switch to full power till time t(soon) delays the fall of

the curve causing the area under it to increase by a statistically

measurable amount K. Fortunately, the curve must come down at time

t(finally) when the hardware solution is finally implemented by

cashless money transfers.

The hardware solution nullifies the gage (gamble) portion of the

mortgage death-gamble in making the communications so good as to

guarantee sure gambles! Today entrepreneurs gamble on their wares

being sold and the weakest are put out of production. Inflation

through confiscation now occurs. This cannot occur in the electronic

medium available in our near future.

When communications become that fast, the slope of the death curve

will change downward until the certain elimination of starvation,

since food production will become a sure thing. The total area under

the curve represents the maximum number of souls who will perish even

if the software solution is never implemented. Though the curve must

eventually come down by the electronic revolution, hastening the

change of slope to time t(now) causes the area under the curve to

decrease saving a statistically measurable slab of humanity A. For

anyone with the power to hasten or delay the software solution,

realize upon reading this that this is your Judgment Day in that there

is now a slab out there with your name on it that is growing and

whether it is a death(K) or a life(A) slab depends purely on your

decision right now.

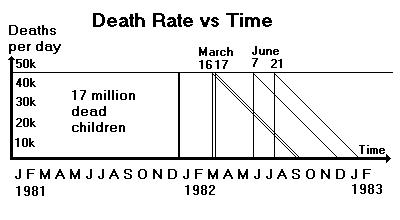

DEATH RATE VS TIME PARALLELOGRAM

It can easily be shown by the parallelogram theorem that the area in

the K slab of the Keepers of the Interest Act is equal to the area

covered during the delay. So, the K slab representing the number of

souls to be lost due to the extra delay is equal to the number of

souls who perish during the delay.

Using the UNICEF estimate of the number of children who perished in

the global village in 1981, 17,000,000, we can now accurately scale

the death curve to get a good idea of the stakes we are gambling. The

daily death rate of children in 1981 was therefore 46,000 per day.

The area between the date of the Court of Appeal hearing on March

16,

1982, and the date of this hearing on June 21, 1982, represents the

number of children who will perish as a direct result of the Court's

failure to comprehend the seriousness of the matter. The number who

will perish as a result of their 97 day delay is equal to the number

who perished during the delay. 46,000 dead children per day times 97

days equals 4,462,000 children who will not live who should have.

Nothing can be done to undo that fact though the magnitude of their

error can be held to a minimum by the immediate solution.

It was to stress the importance of hastening the software solution by

even one day that I sought an Order of Mandamus that the Crown enforce

the Criminal Code Sections against Gerald Bouey one day before this

appeal was to be heard on the morrow in full court.

On Mar 15, Justice Blair had wanted to put off his decision until the

ruling on the morrow of the court in the Mar 16 hearing but the Crown

objected. I explained that given the money system is now 90%

electronic and vulnerable at its central computer to instantaneous

correction, I likened our problem to that of the astronaut attempting

to pull the plug on the killer computer in the movie "2001 A SPACE

ODYSSEY." I stated "Here we sit in front of the killer

computer's

plug. I'm a scientist and I say pull the plug and our mortgage death-

gamble will be over."

It is simple to prove that since the Canadian banking system is

international, if and when it changes to a pure service charge, the

usury banking system will collapse globally. It was to try and save

one day's worth of children, 46,000 souls, that I asked for the

electronic solution one day earlier. Justice Blair decided that he

would not extend time on the matter and dismissed the motion without

costs.

Nevertheless, anyone standing in the way of the quickest

implementation of Global LETS has a K-slab growing from the moment

they realize that LETS funding is the solution to the extinction going

on around us.

I hope this analysis has helped clear up many of the formerly

misrepresented and misunderstood aspects of the usury banking

system as well as explain why usury has been condemned

throughout

history as the greatest crime against humanity. InflationGate is

the only

thing standing between mankind and abundant salvation.